‘How much is my business worth?” A lot of business owners are asking this question for many reasons. Whether you want to purchase, sell or merge a business in any industry, it is important to know exactly how much it is worth in today’s market in order to be in a strong negotiating position.

Valuing a business is not an exact science, which means it is impossible to determine the value of a business with any degree of mathematical accuracy because there are no satisfactory simple or generally accepted formulae that can be used for this purpose.

Instead, the value of a business is determined on the basis of past and potential earnings, the value of its net assets, the value of public companies in the same industry, industry conditions, etc.

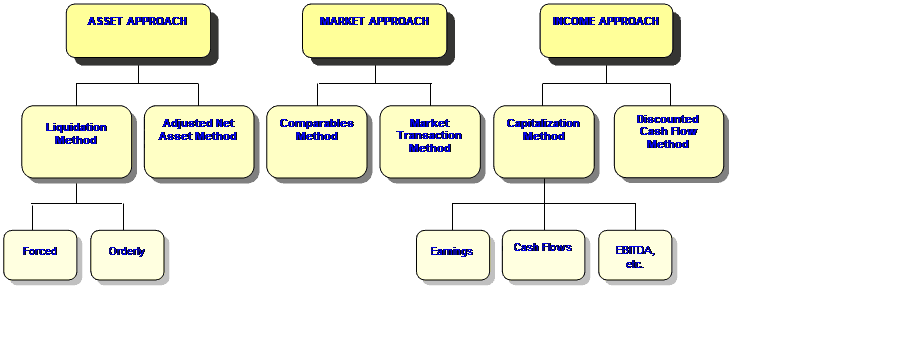

There are three approaches and a number of methods for valuing a company’s shares. These are summarized as follows:

As can be seen, there are various approaches to valuing a business. The value is traditionally based on the income or the value of the assets of the business. The income approach is used in a going concern context where it is assumed the business will be able to continue operating and potentially increase its profitability. The asset approach is generally used when the business does not generate a sufficient return for its shareholders on their invested capital. The required rate of return depends in particular on the risks associated with the industry and the business to be valued.

There is a third alternative, i.e. the market approach (comparable companies or transactions). However, as it is very difficult to obtain precise financial information about comparable transactions because such information is generally highly confidential, this approach is not easy to apply and is more likely to be used to compare the “reasonableness” of the results obtained with the other approaches.

When the approach has been selected, the valuator has to define the appropriate valuation method. For example, the capitalization of maintainable net earnings method can be used under the earnings approach whereas the adjusted net assets method can be used under the asset approach. There are several methods that can be used for each approach. The valuator will select the appropriate method following a thorough analysis of the nature and activities of the business to be valued.

Valuation is above all a question of judgement and perspective. The appropriate approach and methods vary according to each situation. Although there are a variety of ways businesses can be valued, the reasonableness of the results obtained is one of the main hallmarks of a good valuation, which, if based on common sense and well supported, will always be more convincing.